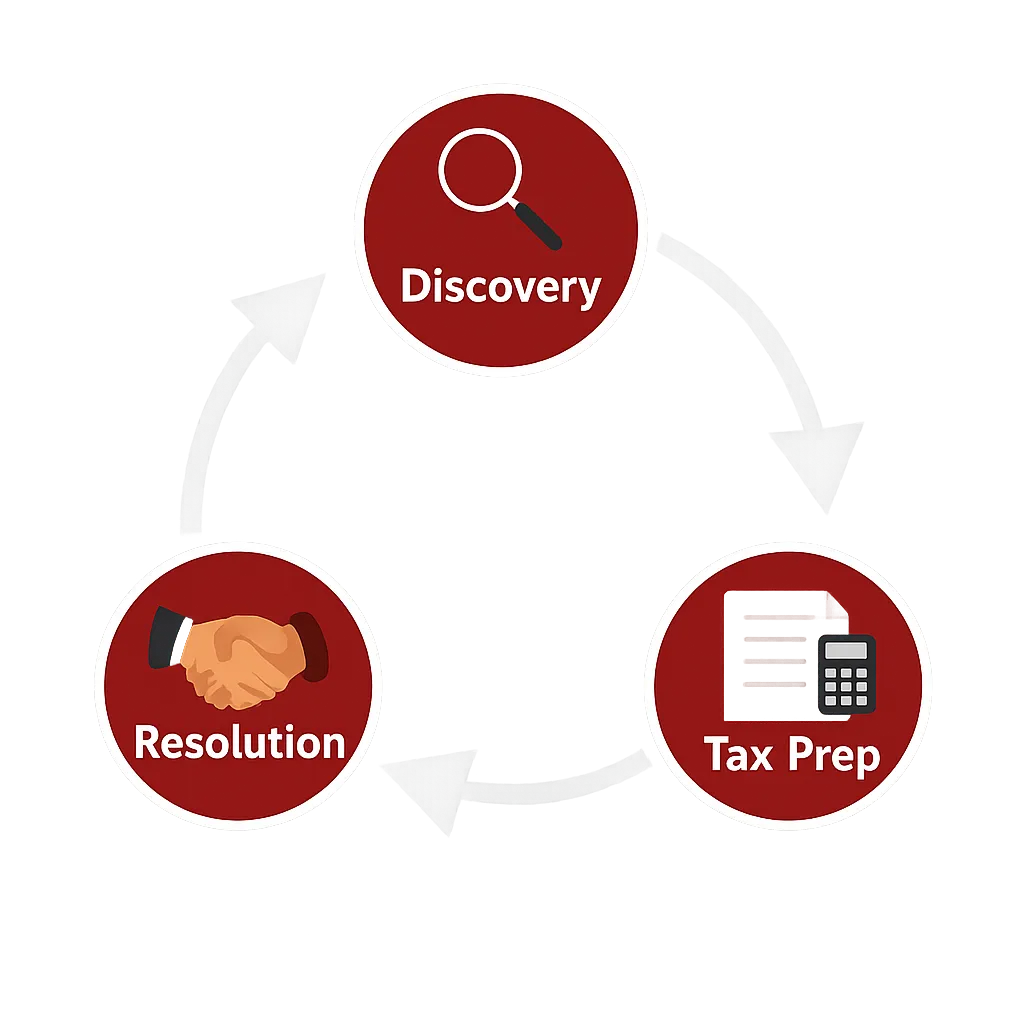

How Our Proven Louisiana Tax Relief Process Works

Clarity Before Commitment. Strategy Before Solutions.

We don’t guess. We investigate. And that’s how we deliver real tax results.

Why Our Discovery Process Matters

Before we resolve your tax debt, we need to understand it completely. Unlike generic tax firms that rush to pitch solutions, we begin with a structured Tax Discovery Process. It's the foundation for any IRS or Louisiana Department of Revenue case we take on. We require full discovery before taking action because every case is different—and outcomes depend on what we uncover.

In some rare cases, tax debts can be wiped out due to expiration, identity errors, or even bankruptcy eligibility. But in most cases, resolution involves negotiation, documentation, and proof which can only be achieved once the facts are laid out in full.

Discovery ensures you’re not misled about your options, you're protected from future enforcement surprises, and you save money, time, and unnecessary stress.

Below are the first areas we assess to build a complete, strategic picture of your tax situation and prevents surprises down the road...

The Tax Itself

How much is owed

Type of tax (income, payroll, etc.)

Taxing authority (IRS, State of Louisiana, or local)

The Timeline

What tax years are involved

Principal vs. penalties and interest

Which years require returns to be filed or amended

Financial Position

Income and expenses

Assets and liabilities

Household size and economic hardship factors

What to Expect From Us During Discovery

Contact the IRS and/or Louisiana Department of Revenue on your behalf

Retrieve encrypted IRS transcripts and decode them line by line for accuracy

Build a simple tax profile showing debts owed, missing returns, and exposure periods

Design a resolution strategy based on your situation and goals

We charge a flat fee for discovery, which includes transcript analysis, solvency evaluation, and a compliance overview.

It’s your roadmap to clarity and it’s what separates us from companies that throw out empty guarantees.

What You’ll Need to Provide

Gathering documentation

To keep things moving, most clients will be asked to provide:

- Prior year tax returns (if available)

- Proof of income (W-2s, 1099s, business revenue)

- Bank statements or other financial data

- Identification and authorization forms

We make the process easy and the sooner we receive documentation, the faster we can act.

Stopping IRS Collection

Stop IRS Collection Actions

The IRS is aggressive, but also cooperative if they know a resolution is in progress. Once we notify them that you’ve retained representation, we typically can:

✅ Stop wage garnishments

✅ Halt levies or seizures

✅ Pause collection activity

✅ Prevent additional penalties

While every case is unique and collections cannot be guaranteed to stop in 100% of scenarios, we’ve been successful in pausing IRS action in the vast majority of client cases.

You Can Fight the IRS Alone or You Can Win with Us by Your Side.

When tax problems arise, trying to handle them alone usually costs more and leads to worse outcomes. Schedule Your Free Consultation Today to Protect Your Paycheck, Your Business, and Your Peace of Mind.

3939 N. Causeway Blvd., Ste 301

Metairie, Louisiana 70002

- Mon-Fri 9am-5pm

Connect with Us

Louisiana Tax Services

Tax Consultation

Tax Negotiation

Tax Preparation

Tax Relief

Tax Resolution

Tax Settlement

Protection Plan

Louisiana Tax Resources

We proudly serve clients across Louisiana, including Baton Rouge, New Orleans, Lafayette, Shreveport, Lake Charles, and all local cities.

© Copyright 2026. Louisiana Tax Relief. All Rights Reserved.

2022 All Rights Reserved.